WAEC 2023 FINANCIAL ACCOUNTING QUESTIONS AND ANSWERS

REFRESH PAGE TO SEE WHEN WE POST ACCOUNTS ANSWERS

NO PAYMENT NO EXPO THOSE WHO PAID enjoyed it since

Verified ACCOUNTS OBJ

1-10: BBBCDCACCB

11-20: CADBAABAAC

21-30: CBCCACBAAC

31-40: CACCACBBCD

41-50: BBDBCCBBAB

(1a)

Incomplete records are financial records that do not contain all necessary information required for the preparation of financial statements.

(1b)

(i)Difficulty in establishing accountability and ownership of assets and liabilities.

(ii)Inability to accurately determine the profitability of the business.

(iii)Difficulty in making informed decisions as the records do not provide adequate information.

(1c)

(i)Lack of knowledge and skills required for record-keeping.

(ii)Cost and time constraints.

(iii)The absence of regulatory requirements mandating complete record-keeping.

========================================

(2a)

The error in this transaction is that consumables should be posted to the consumables account instead of the purchases account. This error will affect the agreement of the trial balance totals.

(2b)

The error in this transaction is that an invoice amount should be posted to the purchases ledger account instead of the purchases day book. This error will not affect the agreement of the trial balance totals.

(2c)

The error in this transaction is that returns outwards should be posted to both the personal account and the returns outwards account. This error will not affect the agreement of the trial balance totals.

(2d)

The error in this transaction is that the cheque payment to Ige was posted on the receipt side of the cash book instead of the payment side, and credited to Ige’s account. This error will affect the agreement of the trial balance totals.

(2e)

Payment of cheque to Ige entered on the receipt side of the cash book and credited to Ige’s account:

Error: The payment of the cheque to Ige was incorrectly entered on the receipt side of the cash book and credited to Ige’s account.

Effect on trial balance: This error would result in an overstatement of receipts and an incorrect entry in Ige’s account.

Impact on trial balance agreement: The error affects the trial balance totals as it misstates the receipts account and potentially Ige’s account.

(3)

(i) Management/Owners

(ii) Investors/Shareholders

(iii) Lenders/Creditors

(iv) Employees/Workers

(v) Government Agencies/Tax Authorities

(i) Management/Owners: The management or owners of a business are interested in accounting information for various purposes. They rely on financial statements and reports to assess the financial performance of the business, make strategic decisions, evaluate profitability, monitor cash flow, and determine the overall financial health of the company. They need accurate and timely accounting information to effectively manage the business and plan for the future.

(ii) Investors/Shareholders: Investors and shareholders are interested in accounting information to evaluate the financial position and performance of a company. They use financial statements and reports to assess the profitability, liquidity, and solvency of the business. This information helps them make investment decisions, evaluate the company’s growth potential, and assess the value of their investments.

(iii) Lenders/Creditors: Lenders and creditors, such as banks or suppliers, rely on accounting information to assess the creditworthiness and financial stability of a business. They use financial statements, particularly the balance sheet and cash flow statement, to evaluate the company’s ability to repay loans or fulfill its financial obligations. Accurate accounting information helps lenders and creditors determine the level of risk associated with extending credit or lending money.

(iv) Employees/Workers: Employees and workers have an interest in accounting information, especially regarding their compensation and benefits. They rely on accurate accounting records to ensure proper calculation of salaries, wages, bonuses, and benefits. Accounting information also helps employees understand the financial health of the company, which may impact job security and potential growth opportunities.

(v) Government Agencies/Tax Authorities: Government agencies and tax authorities require accounting information to ensure compliance with tax regulations, financial reporting standards, and other legal requirements. They use financial statements, tax returns, and supporting documentation to assess tax liabilities, enforce regulations, and monitor financial transparency. Accurate accounting information is crucial for businesses to fulfill their legal obligations and avoid penalties or legal issues.

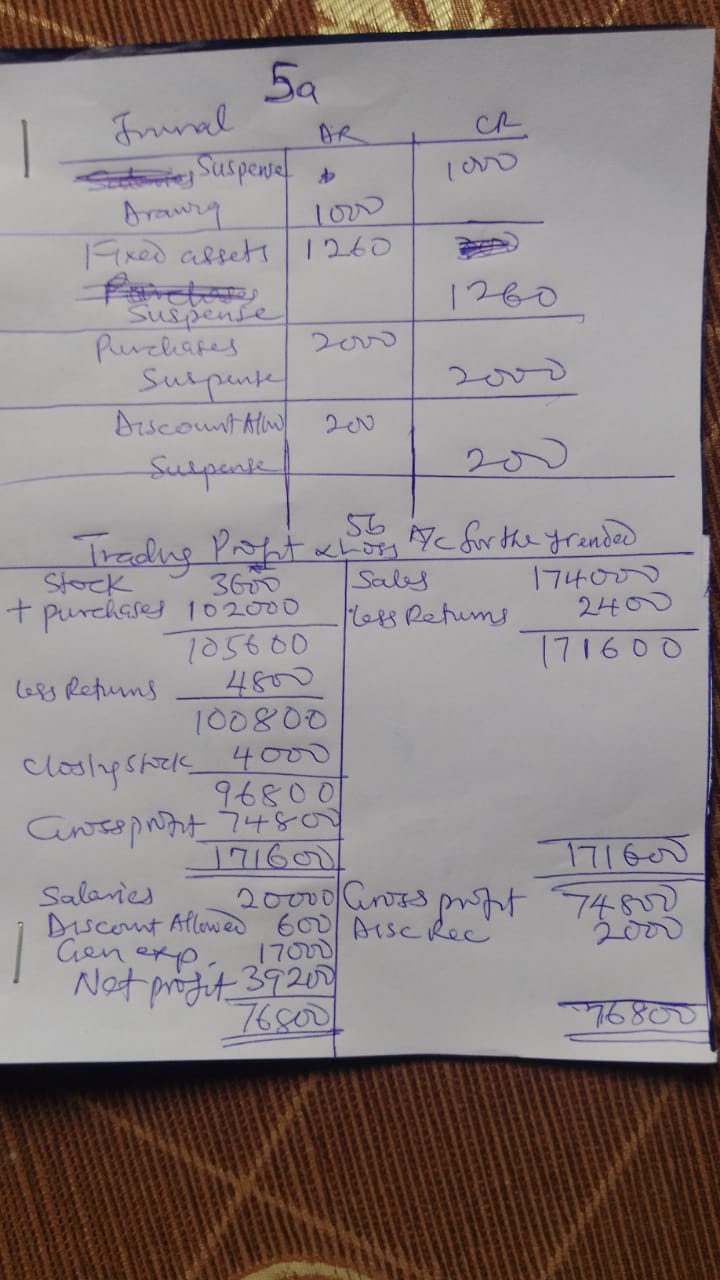

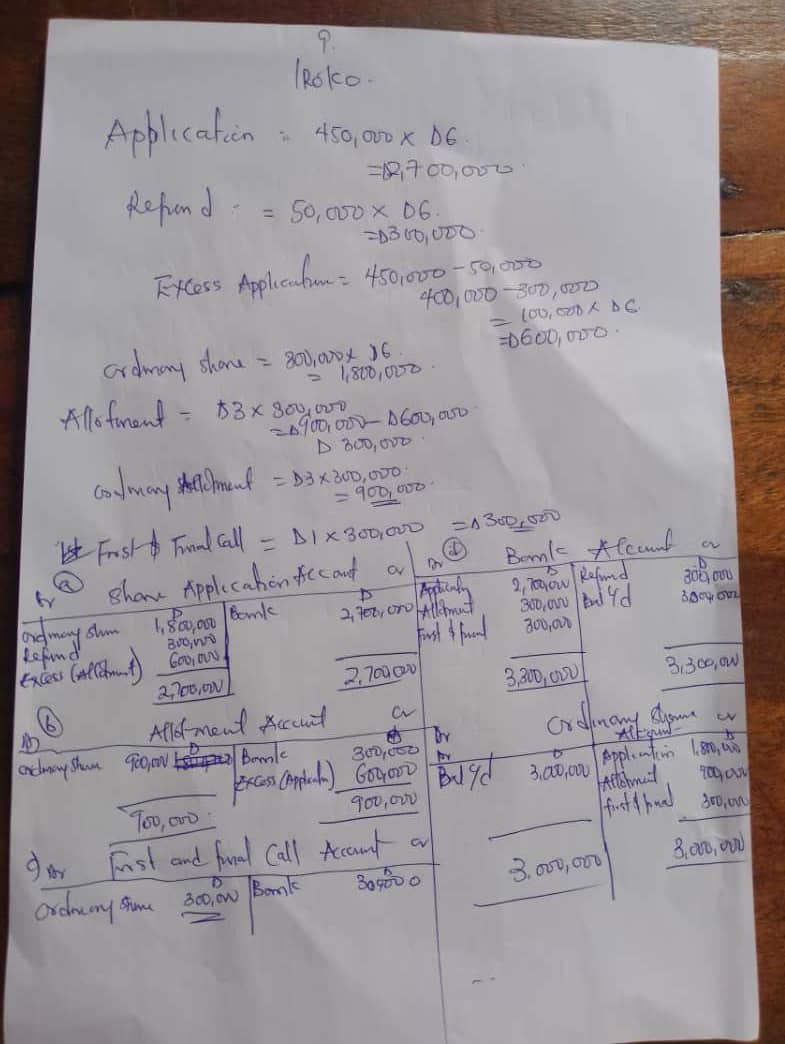

No5 and 9 bellow

More coming

===== REFRESH PAGE HERE

NOTE:: WAEC ACCOUNTS THEORY & OBJ ANSWERS WILL BE POSTED HERE 22nd NIGHT BY 11:pm against 23rd morning which is the exam date….

THIS PAGE WILL BE LOCKED WITH PASSWORD ON 22nd BY 9:pm at Night only those with the password will be able to see the answers!!!

IF U WANT JUST ONLY ACCOUNTS PASWORD PAY #500 TO THE BANK ACCOUNT BELLOW & SMS LIKE THIS ( I PAID #500 FOR ACCOUNTING AND WE SHALL SEND U UR PASWORD IMMEDIATELY.. BUT IF U WANT ALL UR REMAINING SUBJECTS PAY JUST 2K

==============≠=======

*WAEC 2023 FIN ACCOUNTS QUESTIONS & ANSWERS *

FOR ALL UR REMAINING SUBJECTS PAY UR #2,000 AND JOIN THE WAEC VIP FOR ALL UR REMAINING SUBJECTS ANSWERS NOW!! PROMO ENDS MONDAY 22nd MAY BY 9pm at night…

=BABA REMAINS BABA*

WAEC 2023 FIN ACCOUNTS LOADING……………..

DO U WISH TO GET ALL UR WAEC REMAINING SUBJECTS AT NIGHT BEFORE EXAM? WE ARE CHARGING U JUST A TOKEN OF #2000 ONLY TO HELP U GET ALL UR WAEC QUESTIONS AND ANSWERS AT NIGHT BEFORE UR EXAM… PAY THE #2000 TO OUR UBA ACCOUNT NO=2294522303 Name= UCHE WISDOM GOODLUCK… BANK IS (UBA) IF U PAY JUST SEND AN SMS LIKE THIS I PAID #2000 FOR MY WAEC ALL SUBJECTS+UR SUBJECTS+UR PHONE NUMBER SEND AS SMS TO MR ABILITY ON 07067800301. U WILL GET A CONFIRMATION TEXT AND U WILL BE GETTING UR DAILY PASSWORD AT NIGHT FOR EACH SUBJECT…. NOTE: ONLY PHYSICS IS JUST #500 TO SAME BANK ACCOUNT AND SMS OR WHATSAPP US AS WELL

PLS IF U ARE ON WHATSAPP AFTER TRANSFER JUST SEND UR PAY SLIP TO MR ABILITY ON WHATSAPP 07067800301 AND WE SHALL ADD U INTO THE WAEC VIP GROUP WHERE WE POST ALL WAEC ANSWERS AT NIGHT BEFORE EXAMS

ARE U NOT ON WHATSAPP? IF U PAY JUST SEND UR SUBJECTS+UR PHONE NUMBER AS SMS TO MR ABILITY ON 07067800301 WE SHALL ALWAYS SEND U THE PASSWORD/LINK TO SEE UR ANSWERS AT NIGHT BEFORE EXAM… AND IF U PAY JUST SENT US A TEXT IMMEDIATELY TO VERIFY UR PAYMENT OK

CLICK HERE TO SEE WHEN WE POST THE ACCOUNTS ANSWERS

===INVITE OTHERS NOW!!!!!!========

Leave a Reply